There is much discussion as to whether the inflation pressures of today will rival the double-digit inflation of the 1970s in America. Then, America experienced nationwide gas shortages, wage increases, higher prices, and some vaguely similar supply chain issues, though much has changed in the last half-century. The inflationary pressures felt in the 1970s were primarily confined to our country. Today, we face global inflation. The closest historical example is the Great Depression which had severe worldwide economic effects.

We also weren’t so incredibly dependent upon a global supply chain. There were products, goods, and agricultural commodities produced in America. We navigated even the hardships of the Dust Bowl through it all. Inflation is now a global crisis. Supply-chain bottlenecks, a global pandemic, energy prices, and a labor shortage are just a few of the elements combining to create a problem of international concern. Unlike previous times in our history, the Federal reserve lacks many of the tools it has previously held at its disposal. Interest rates can’t be brought lower to prop up the markets. Borrowing money to print money only worsens the current status quo politics and further devalues the dollar.

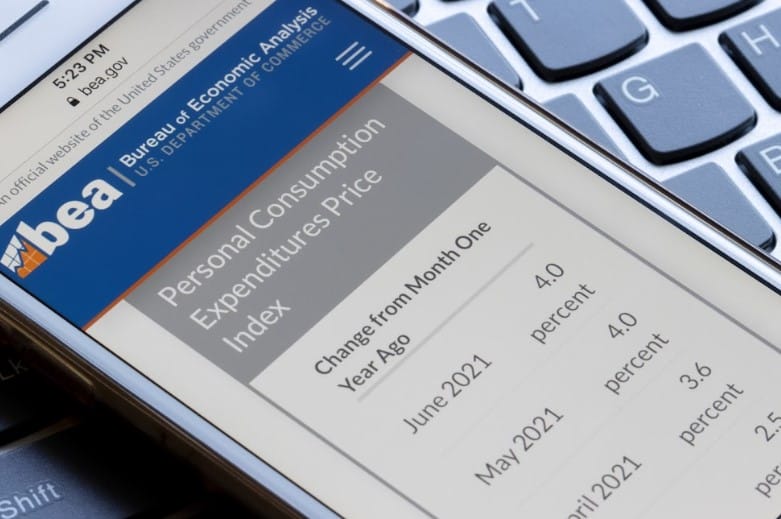

The way we measured inflation a half-century ago doesn’t keep pace with modern expenses and costs, so comparing the inflation of then to now allows for a considerable amount left up to interpretation. The current Administration claims the inflation we are seeing now is transitory. They claim that once demand settles and the supply chain restores itself a bit, inflation will stabilize. It has currently been above 5% for the last six months. The Treasury Secretary would have you believe that it will settle next year to a comfortable and manageable 2%. Investors, though, seem reluctant to accept these rosy assessments and casual dismissals. After her announcement, U.S. stocks fell, and bond yields rose as investors began to reckon with the impact of price pressure on the global economy.

The Great Inflation of the 1970s was brought about by the complete move away from the gold standard, high demand in a period of low supply, high wages, and high unemployment for others, and it was perhaps even accelerated by the economic measures referred to as the “Nixon shock.” While some comparisons can be made, and anecdotal evidence can connect a few dots and draw a few parallels between then and now, it was primarily a different beast. The global inflation we face today has been decades in the making, and we can’t really see how bad it will get. It has been stoked by a pandemic, trade wars, supply-chain failures, a continually weakening dollar, and a rising national debt. We also can’t say with certainty, like many economists are, that we won’t return to the double-digit inflation of the 70s. For many things, we are already in double digits. Even the most conservative of estimates put inflation today at a 30-year high.

ARE WE BEING LIED TO?

There is much discussion as to whether the inflation pressures of today will rival the double-digit inflation of the 1970s in America. Then, America experienced nationwide gas shortages, wage increases, higher prices, and some vaguely similar supply chain issues, though much has changed in the last half-century. The inflationary pressures felt in the 1970s were primarily confined to our country. Today, we face global inflation. The closest historical example is the Great Depression which had severe worldwide economic effects.

We also weren’t so incredibly dependent upon a global supply chain. There were products, goods, and agricultural commodities produced in America. We navigated even the hardships of the Dust Bowl through it all. Inflation is now a global crisis. Supply-chain bottlenecks, a global pandemic, energy prices, and a labor shortage are just a few of the elements combining to create a problem of international concern. Unlike previous times in our history, the Federal reserve lacks many of the tools it has previously held at its disposal. Interest rates can’t be brought lower to prop up the markets. Borrowing money to print money only worsens the current status quo politics and further devalues the dollar.

The way we measured inflation a half-century ago doesn’t keep pace with modern expenses and costs, so comparing the inflation of then to now allows for a considerable amount left up to interpretation. The current Administration claims the inflation we are seeing now is transitory. They claim that once demand settles and the supply chain restores itself a bit, inflation will stabilize. It has currently been above 5% for the last six months. The Treasury Secretary would have you believe that it will settle next year to a comfortable and manageable 2%. Investors, though, seem reluctant to accept these rosy assessments and casual dismissals. After her announcement, U.S. stocks fell, and bond yields rose as investors began to reckon with the impact of price pressure on the global economy.

The Great Inflation of the 1970s was brought about by the complete move away from the gold standard, high demand in a period of low supply, high wages, and high unemployment for others, and it was perhaps even accelerated by the economic measures referred to as the “Nixon shock.” While some comparisons can be made, and anecdotal evidence can connect a few dots and draw a few parallels between then and now, it was primarily a different beast. The global inflation we face today has been decades in the making, and we can’t really see how bad it will get. It has been stoked by a pandemic, trade wars, supply-chain failures, a continually weakening dollar, and a rising national debt. We also can’t say with certainty, like many economists are, that we won’t return to the double-digit inflation of the 70s. For many things, we are already in double digits. Even the most conservative of estimates put inflation today at a 30-year high.

ARE WE BEING LIED TO?

If we ask the question, are we being lied to, the answer is almost always ‘probably.” Most people can’t handle the unvarnished truth. Most people avoid telling the objective truth. It’s not in the government’s best interests to tell you that “yeah, inflation is going to get really bad here over at least the next year.” That derails the pandemic recovery efforts and spurns panic buying activities that will exacerbate the current supply-chain problems. As the most widely used measure of inflation, the Consumer Price Index is an indicator of the effectiveness of government policy. In addition, business executives, labor leaders, and other private citizens use the index as a guide in making economic decisions. Any set of statistics can be read in different ways, so while a few measures on the CPI may be hitting new record highs, others may only show moderate advances. It’s those slower movers that the spinners of good news will want to focus on while they also point out job growth, wage growth, and their efforts to correct the bottleneck at the ports. Personally, we’re not vested in any particular party’s assessment of the optimism or doom we face. We think when we focus on the evaluation they’re trying to feed us, we fail to pull the curtain back for ourselves and really see what’s working the levers and switches.

That being said, we think some have a vested interest in portraying doom for the economy, and some have a vested interest in convincing people that everything is to be as expected and will get better, not worse. Somewhere between those views is reality. That reality is that we are seeing global inflationary pressures that will force different countries, different federal banks, different business reactions, and different consumer choices like we haven’t seen before. New vehicles are only up 1.4%, used are only up 2.5%. Sounds great, right? The unadjusted 12-month increase is 9.8% for new cars and a whopping 26.4% increase for used vehicles.

The numbers can be interpreted in different ways. Still, it’s important to note that what the press provides you with, the neat, curated reports from the US Bureau of Labor Statistics are populated with information that is already two months old and typically only reflects the month-to-month increase. The increase or declines are only based on the previous month, so the price of something might have doubled the month before but only climbed a few percentage points in its recent month.

They’re also a set of handpicked items that may not relate to you. You may not be concerned with the light to nonexistent CPI percentage change for physician services, tobacco and smoking products, apparel, or airline fares. Still, those numbers are in there to soften the harshness of a 12.3 percent rise in motor fuel, a 6.2 percent rise in fuel oil, a 3% rise in energy services, and so forth. Not only are the numbers already two months old when they’re delivered to you via press, politician, or pundit, but they might not reflect your real spending needs.

So, we wouldn’t say we’re being lied to as much as we would say that we are getting shades of truth based on curated data. There are other signs you should be looking at, and here are a few.

SIGNS TO PAY ATTENTION TO

If we ask the question, are we being lied to, the answer is almost always ‘probably.” Most people can’t handle the unvarnished truth. Most people avoid telling the objective truth. It’s not in the government’s best interests to tell you that “yeah, inflation is going to get really bad here over at least the next year.” That derails the pandemic recovery efforts and spurns panic buying activities that will exacerbate the current supply-chain problems. As the most widely used measure of inflation, the Consumer Price Index is an indicator of the effectiveness of government policy. In addition, business executives, labor leaders, and other private citizens use the index as a guide in making economic decisions. Any set of statistics can be read in different ways, so while a few measures on the CPI may be hitting new record highs, others may only show moderate advances. It’s those slower movers that the spinners of good news will want to focus on while they also point out job growth, wage growth, and their efforts to correct the bottleneck at the ports. Personally, we’re not vested in any particular party’s assessment of the optimism or doom we face. We think when we focus on the evaluation they’re trying to feed us, we fail to pull the curtain back for ourselves and really see what’s working the levers and switches.

That being said, we think some have a vested interest in portraying doom for the economy, and some have a vested interest in convincing people that everything is to be as expected and will get better, not worse. Somewhere between those views is reality. That reality is that we are seeing global inflationary pressures that will force different countries, different federal banks, different business reactions, and different consumer choices like we haven’t seen before. New vehicles are only up 1.4%, used are only up 2.5%. Sounds great, right? The unadjusted 12-month increase is 9.8% for new cars and a whopping 26.4% increase for used vehicles.

The numbers can be interpreted in different ways. Still, it’s important to note that what the press provides you with, the neat, curated reports from the US Bureau of Labor Statistics are populated with information that is already two months old and typically only reflects the month-to-month increase. The increase or declines are only based on the previous month, so the price of something might have doubled the month before but only climbed a few percentage points in its recent month.

They’re also a set of handpicked items that may not relate to you. You may not be concerned with the light to nonexistent CPI percentage change for physician services, tobacco and smoking products, apparel, or airline fares. Still, those numbers are in there to soften the harshness of a 12.3 percent rise in motor fuel, a 6.2 percent rise in fuel oil, a 3% rise in energy services, and so forth. Not only are the numbers already two months old when they’re delivered to you via press, politician, or pundit, but they might not reflect your real spending needs.

So, we wouldn’t say we’re being lied to as much as we would say that we are getting shades of truth based on curated data. There are other signs you should be looking at, and here are a few.

SIGNS TO PAY ATTENTION TO

The first prominent real-time inflationary index for you is your actual spending and purchasing power. If it cost you 26 dollars to fill your tank in January and here at the end of the year it’s costing you 38 dollars, that’s a genuine increase for you. That increase is in alignment with the national gas price. A year ago, a pound of chicken would have cost you at least 32% less, according to the USDA. In the past year, the overall consumer price index for food barely rose a percentage point, while the index for beef rose 17.6%. To diagnose this problem further, other indicators indicate that food inflation is about to break out to all new highs. The energy crisis and spike in energy costs mean fewer synthetic fertilizers are being manufactured, and several major producers in Europe have already scaled back production.

This, in turn, means lower yields and higher costs while demand stays steady or increases out of panic about scarcity. This means the feed grain price goes up simultaneously with the price of your corn on the cob, corn chips, Ethanol, and all products using corn starch or corn syrup. Corn is just one of the feed grains, too. Anticipating this price increase, ranchers and corporate ranches purposely contain the population and downsize their production. This creates a high demand for beef but insulates them from the high costs of feeding all those heads of cattle. The doubling of fertilizer prices leads to a 44% increase in food prices, but fertilizer prices have tripled already and may quadruple in the coming months. This would lead to a 66 to 88% jump in food prices across all categories. We haven’t yet realized this in the current prices for a hamburger or a piece of stew meat or bio-plastics, but we will. Pay attention to the farm reports and the price of grain and fertilizer. Lower yields and food scarcity will likely drive prices even higher.

Another sign this will continue to levels we can’t yet determine is the bottlenecks in the supply chain. We have delved deep into the supply chain issues in other videos on this channel because we have an over-dependence on it, and it’s failing again and again. We are heading into a season of consumption as people gather for the holidays and shop for gifts. The economic downturn will worsen if businesses place their anticipated orders but fail to receive their product to resell or modify to resell to consumers. If glaring shortages of some items or price spikes cause panic buying, you can bet that the media will amplify the panic buying, leading to an even greater depletion of inventory and shortages. Those shortages and depletions will translate into higher demand which will push the prices even higher. Pay attention to shortages and supply chain problems and understand that one shortage may indicate a broader problem. The supply of milk might be just fine, but there may be a shortage of packaging materials. The stores might still sell the product, but the delivery date might be further down the calendar, then pushed further again.

In some sense, you can blame it on the weather. Weather extremes are a definite sign to pay attention to. Extreme cold, as is forecasted, or winter storms that cause wide scale outages ripple across the supply chain and further complicate inventory and availability. Consider what is produced or passes through the affected areas. Those things are likely to be in short supply or will carry a higher price tag in your immediate future.

One sign that things are getting better is if fuel prices come down. U.S. prices for natural gas and oil are trading close to multi-year highs amid a global squeeze on supplies and labor shortages at U.S. coal mines, adding to woes. When the cost of fuel, electricity and natural gas remain high, the cost to make or produce anything goes up. That cost will influence whether producers scale back production or ramp up production to meet a fulfillable level of demand. Fuel costs will also determine how much money is left in consumers’ wallets to spend on other necessities and luxuries. It will determine how freely consumers and investors spend versus holding onto their dollars. High fuel costs actually determine the speed of the economy in this way.

Finally, pay attention to the first quarter of next year. Right now, a shortage of workers needed to meet consumer demand is putting upward pressure on wages, adding to companies’ motivations to raise prices to offset higher labor costs. If unemployment numbers continue to decline and wages show slow, not dramatic increases, the chances of price stabilization are greater, and runaway inflation is less likely. In a perfect scenario, the supply chain issues get worked out, no panic buying occurs, and cautious consumers slow spending. At the same time, businesses are still able to fulfill orders and maintain profits reasonably. Unemployment decreases while wages advance a little. If that all occurs in the first quarter of next year, it will probably have us coming out of the intense inflationary pressure we are seeing today. At the very least, warmer weather should reduce demand for fuel and provide some relief at the pumps and on utility bills. If any of these things go sideways, though, over the next few months, they could fan the inflationary flames even further, dash any recovery efforts, and propel us into an even deeper global recession.

WHAT YOU SHOULD DO

The first prominent real-time inflationary index for you is your actual spending and purchasing power. If it cost you 26 dollars to fill your tank in January and here at the end of the year it’s costing you 38 dollars, that’s a genuine increase for you. That increase is in alignment with the national gas price. A year ago, a pound of chicken would have cost you at least 32% less, according to the USDA. In the past year, the overall consumer price index for food barely rose a percentage point, while the index for beef rose 17.6%. To diagnose this problem further, other indicators indicate that food inflation is about to break out to all new highs. The energy crisis and spike in energy costs mean fewer synthetic fertilizers are being manufactured, and several major producers in Europe have already scaled back production.

This, in turn, means lower yields and higher costs while demand stays steady or increases out of panic about scarcity. This means the feed grain price goes up simultaneously with the price of your corn on the cob, corn chips, Ethanol, and all products using corn starch or corn syrup. Corn is just one of the feed grains, too. Anticipating this price increase, ranchers and corporate ranches purposely contain the population and downsize their production. This creates a high demand for beef but insulates them from the high costs of feeding all those heads of cattle. The doubling of fertilizer prices leads to a 44% increase in food prices, but fertilizer prices have tripled already and may quadruple in the coming months. This would lead to a 66 to 88% jump in food prices across all categories. We haven’t yet realized this in the current prices for a hamburger or a piece of stew meat or bio-plastics, but we will. Pay attention to the farm reports and the price of grain and fertilizer. Lower yields and food scarcity will likely drive prices even higher.

Another sign this will continue to levels we can’t yet determine is the bottlenecks in the supply chain. We have delved deep into the supply chain issues in other videos on this channel because we have an over-dependence on it, and it’s failing again and again. We are heading into a season of consumption as people gather for the holidays and shop for gifts. The economic downturn will worsen if businesses place their anticipated orders but fail to receive their product to resell or modify to resell to consumers. If glaring shortages of some items or price spikes cause panic buying, you can bet that the media will amplify the panic buying, leading to an even greater depletion of inventory and shortages. Those shortages and depletions will translate into higher demand which will push the prices even higher. Pay attention to shortages and supply chain problems and understand that one shortage may indicate a broader problem. The supply of milk might be just fine, but there may be a shortage of packaging materials. The stores might still sell the product, but the delivery date might be further down the calendar, then pushed further again.

In some sense, you can blame it on the weather. Weather extremes are a definite sign to pay attention to. Extreme cold, as is forecasted, or winter storms that cause wide scale outages ripple across the supply chain and further complicate inventory and availability. Consider what is produced or passes through the affected areas. Those things are likely to be in short supply or will carry a higher price tag in your immediate future.

One sign that things are getting better is if fuel prices come down. U.S. prices for natural gas and oil are trading close to multi-year highs amid a global squeeze on supplies and labor shortages at U.S. coal mines, adding to woes. When the cost of fuel, electricity and natural gas remain high, the cost to make or produce anything goes up. That cost will influence whether producers scale back production or ramp up production to meet a fulfillable level of demand. Fuel costs will also determine how much money is left in consumers’ wallets to spend on other necessities and luxuries. It will determine how freely consumers and investors spend versus holding onto their dollars. High fuel costs actually determine the speed of the economy in this way.

Finally, pay attention to the first quarter of next year. Right now, a shortage of workers needed to meet consumer demand is putting upward pressure on wages, adding to companies’ motivations to raise prices to offset higher labor costs. If unemployment numbers continue to decline and wages show slow, not dramatic increases, the chances of price stabilization are greater, and runaway inflation is less likely. In a perfect scenario, the supply chain issues get worked out, no panic buying occurs, and cautious consumers slow spending. At the same time, businesses are still able to fulfill orders and maintain profits reasonably. Unemployment decreases while wages advance a little. If that all occurs in the first quarter of next year, it will probably have us coming out of the intense inflationary pressure we are seeing today. At the very least, warmer weather should reduce demand for fuel and provide some relief at the pumps and on utility bills. If any of these things go sideways, though, over the next few months, they could fan the inflationary flames even further, dash any recovery efforts, and propel us into an even deeper global recession.

WHAT YOU SHOULD DO

With almost a guarantee that prices will increase in the foreseeable future, there are some things you can do to insulate yourself a bit. If things get even worse than is forecasted, you will be glad you did. Survival all comes down to the availability of resources. Right now, resources like food and water might be within arm’s length. If you were in the middle of a desert, alone and on foot, your odds of survival are decreased because your access to resources is reduced. So, as a prepper, you want to first bring your resources up to a level to sustain you through periods of resource scarcity, in this case first being priced out of the market and second the item disappearing from the shelves altogether. Think of your prepper pyramid first: food, water, and energy.

First, as a prepper, you have to make sure your food supply can sustain you for as long as possible. For some preppers, large pantries and maybe even a stocked basement or root cellar could have them with abundant food far into any shortages. For others, with budget or space constraints, having a large enough food supply on hand will always present challenges—stock up on the essentials. Buy just a little extra each trip and set it aside for some future needs. Learn how to prepare, preserve and store a wide range of food resources. Make sure you have both water stored and a means to filter and purify water. It could be argued that high prices are forever, but economic downturns are not. Though some downturns can turn from months to years to a decade, they do tend to resolve themselves at some point. From the prepared perspective, you aren’t necessarily looking to survive a long period of being completely without any external resources like you might after a catastrophic disaster. You are looking to survive a period of scarcity that is erratic, short-lived, and sometimes seemingly incoherent.

The third piece of this pyramid is to assess your energy needs. If you are expecting a 60 to 80% rate increase in heating your home, like those in Maine are right now, start living your life like it’s already happened. Calculate that difference on your utility bill now and set the extra money aside to lessen the shock when the higher bill does come. Consider other methods of heating your home and secure those methods now. Do you need a generator, electric heater, kerosene heater, or are you planning on building a candle heater in an emergency? You might want to get what you think you will need now before the rush in demand, further shortages, or time runs out.

Consider your future availability of resources in the future and let that guide you in your prepping. Many will hardly feel the inflationary effects no matter how bad they get because they have long ago internalized three secrets of prepping–allocating resources to the future, educating oneself on how to do more with less, and recognizing assets while reducing liabilities. I always say this isn’t an investment channel, and I don’t give investment advice. That said, you have to invest your time and money as if this inflation will get worse, and it likely will. For some of you, that may be an investment in time in learning a new skill. It may mean an initial investment to get a garden planned and started for Spring. It may mean learning a new skill like growing microgreens, cooking, dehydrating or canning foods, sewing, or repairing things. For some, it may mean investing money or reallocating money into more stable assets that can grow through inflation, like land or bonds. Even without extra money, learning to define your assets and liabilities by reading authors like Suze Orman, Dave Ramsey, Robert Kiyosaki, and David Bach will keep you ahead of inflation in many ways. Many have never read a book on improving personal finances, and there is no cookie-cutter, one size fits all answer, though many of these authors would have you believe there is. What learning the lessons from these books does for you, though, is that it teaches you to recognize both your assets and liabilities, use your resources more wisely, and establish a plan tailored to your needs. The byproduct of these outcomes is that your financial preps can sustain the most likely disasters from the natural to the economic kind.

The bottom line is that even without money and with less of it in your pocket because of inflation and stagnant wages, begin to educate yourself. Stay ahead of inflation by understanding the fundamentals of economics and finance and learn to recognize your assets and liabilities, maximize your efficiency, and establish a solid foundation of personal resources. In this way, you set your own sails rather than fall victim to the shifting winds. Approach your finances and income as a resource as important as your food, water, and energy. We could tell you to invest in crypto, precious metals, or buy land, and all of those would be sound investments for some; however, you need to focus first on your pyramid of preps– water, food, and energy. Then focus on your knowledge of how to recognize your assets and liabilities. When you have done all that, the massive inflation we are facing right now will be a storm you have prepared for in advance.

CONCLUSION

There you have it. We can only draw a few parallels to inflation we have witnessed in the past. Several indicators all point to our need to buckle up for what could be a wild ride of price increases, continued shortages, panic buying, hoarding, and attempts by governments around the world to downplay the severity while implementing policies that aren’t guaranteed to work. This is a new animal let loose in an already vulnerable system. We don’t yet have the terms to define it, but we will likely look back on this period as the last chance we had to get prepared. Those that prep will emerge from what is left stronger than those who did nothing, downplayed the obvious indicators, and clutched their pearls in the aftermath, wondering how we got here. Does that sound too extreme? With inflation already at a 31-year high and no clear end in sight but many other indicators worldwide looking bad, my assessment here might not be excessive or harsh enough.

What do you think? What’s the most significant price increase you’re experiencing, and how will that affect others in the future? What’s your assessment of the global economy, and what are you doing to protect yourself from it crashing? Let us know in the comments below. What woke you up to begin to prep? What’s your prepping plan?

As always, stay safe out there.

With almost a guarantee that prices will increase in the foreseeable future, there are some things you can do to insulate yourself a bit. If things get even worse than is forecasted, you will be glad you did. Survival all comes down to the availability of resources. Right now, resources like food and water might be within arm’s length. If you were in the middle of a desert, alone and on foot, your odds of survival are decreased because your access to resources is reduced. So, as a prepper, you want to first bring your resources up to a level to sustain you through periods of resource scarcity, in this case first being priced out of the market and second the item disappearing from the shelves altogether. Think of your prepper pyramid first: food, water, and energy.

First, as a prepper, you have to make sure your food supply can sustain you for as long as possible. For some preppers, large pantries and maybe even a stocked basement or root cellar could have them with abundant food far into any shortages. For others, with budget or space constraints, having a large enough food supply on hand will always present challenges—stock up on the essentials. Buy just a little extra each trip and set it aside for some future needs. Learn how to prepare, preserve and store a wide range of food resources. Make sure you have both water stored and a means to filter and purify water. It could be argued that high prices are forever, but economic downturns are not. Though some downturns can turn from months to years to a decade, they do tend to resolve themselves at some point. From the prepared perspective, you aren’t necessarily looking to survive a long period of being completely without any external resources like you might after a catastrophic disaster. You are looking to survive a period of scarcity that is erratic, short-lived, and sometimes seemingly incoherent.

The third piece of this pyramid is to assess your energy needs. If you are expecting a 60 to 80% rate increase in heating your home, like those in Maine are right now, start living your life like it’s already happened. Calculate that difference on your utility bill now and set the extra money aside to lessen the shock when the higher bill does come. Consider other methods of heating your home and secure those methods now. Do you need a generator, electric heater, kerosene heater, or are you planning on building a candle heater in an emergency? You might want to get what you think you will need now before the rush in demand, further shortages, or time runs out.

Consider your future availability of resources in the future and let that guide you in your prepping. Many will hardly feel the inflationary effects no matter how bad they get because they have long ago internalized three secrets of prepping–allocating resources to the future, educating oneself on how to do more with less, and recognizing assets while reducing liabilities. I always say this isn’t an investment channel, and I don’t give investment advice. That said, you have to invest your time and money as if this inflation will get worse, and it likely will. For some of you, that may be an investment in time in learning a new skill. It may mean an initial investment to get a garden planned and started for Spring. It may mean learning a new skill like growing microgreens, cooking, dehydrating or canning foods, sewing, or repairing things. For some, it may mean investing money or reallocating money into more stable assets that can grow through inflation, like land or bonds. Even without extra money, learning to define your assets and liabilities by reading authors like Suze Orman, Dave Ramsey, Robert Kiyosaki, and David Bach will keep you ahead of inflation in many ways. Many have never read a book on improving personal finances, and there is no cookie-cutter, one size fits all answer, though many of these authors would have you believe there is. What learning the lessons from these books does for you, though, is that it teaches you to recognize both your assets and liabilities, use your resources more wisely, and establish a plan tailored to your needs. The byproduct of these outcomes is that your financial preps can sustain the most likely disasters from the natural to the economic kind.

The bottom line is that even without money and with less of it in your pocket because of inflation and stagnant wages, begin to educate yourself. Stay ahead of inflation by understanding the fundamentals of economics and finance and learn to recognize your assets and liabilities, maximize your efficiency, and establish a solid foundation of personal resources. In this way, you set your own sails rather than fall victim to the shifting winds. Approach your finances and income as a resource as important as your food, water, and energy. We could tell you to invest in crypto, precious metals, or buy land, and all of those would be sound investments for some; however, you need to focus first on your pyramid of preps– water, food, and energy. Then focus on your knowledge of how to recognize your assets and liabilities. When you have done all that, the massive inflation we are facing right now will be a storm you have prepared for in advance.

CONCLUSION

There you have it. We can only draw a few parallels to inflation we have witnessed in the past. Several indicators all point to our need to buckle up for what could be a wild ride of price increases, continued shortages, panic buying, hoarding, and attempts by governments around the world to downplay the severity while implementing policies that aren’t guaranteed to work. This is a new animal let loose in an already vulnerable system. We don’t yet have the terms to define it, but we will likely look back on this period as the last chance we had to get prepared. Those that prep will emerge from what is left stronger than those who did nothing, downplayed the obvious indicators, and clutched their pearls in the aftermath, wondering how we got here. Does that sound too extreme? With inflation already at a 31-year high and no clear end in sight but many other indicators worldwide looking bad, my assessment here might not be excessive or harsh enough.

What do you think? What’s the most significant price increase you’re experiencing, and how will that affect others in the future? What’s your assessment of the global economy, and what are you doing to protect yourself from it crashing? Let us know in the comments below. What woke you up to begin to prep? What’s your prepping plan?

As always, stay safe out there.