Workforce and employment numbers are an often overlooked side effect of higher gas prices. Precisely when economies are struggling to regain their footing and recover from the pandemic lockdowns and repeated supply chain disruptions, millions are determining whether employment in a job that doesn’t make ends meet is tenable for the future. This will increase the ranks of the unemployed while also pumping the breaks on the economy. Put your hopes for an economic recovery off for the next year or two at the very best.

2: Higher Production Costs

Workforce and employment numbers are an often overlooked side effect of higher gas prices. Precisely when economies are struggling to regain their footing and recover from the pandemic lockdowns and repeated supply chain disruptions, millions are determining whether employment in a job that doesn’t make ends meet is tenable for the future. This will increase the ranks of the unemployed while also pumping the breaks on the economy. Put your hopes for an economic recovery off for the next year or two at the very best.

2: Higher Production Costs

When fuel prices go up, the cost of production goes up. Whether you are mining silver or growing corn, it doesn’t matter. Raw materials require low-cost fuel to remain profitable. When the cost of generating the raw materials and getting those materials to manufacturers and consumers outweighs profit, farmers opt not to grow, and companies scale back production even as demand remains high. High demand and lower output results in price increases and even outright shortages.

3: Higher Manufacturing Costs

When fuel prices go up, the cost of production goes up. Whether you are mining silver or growing corn, it doesn’t matter. Raw materials require low-cost fuel to remain profitable. When the cost of generating the raw materials and getting those materials to manufacturers and consumers outweighs profit, farmers opt not to grow, and companies scale back production even as demand remains high. High demand and lower output results in price increases and even outright shortages.

3: Higher Manufacturing Costs

Even if that farmer grows corn for feed grain and gets it to the rancher and the local factories, fuel-related costs are associated with the next phase- manufacturing. The manufacturers have to process these raw materials into usable consumer products. Low-cost fuel is required to get the materials to the plant, process them, and distribute the final product to stores and retailers. High-priced fuel results in scaling back operations or raising prices, or both– even as consumer demand remains high or increases.

4: Higher Retail Costs

Even if that farmer grows corn for feed grain and gets it to the rancher and the local factories, fuel-related costs are associated with the next phase- manufacturing. The manufacturers have to process these raw materials into usable consumer products. Low-cost fuel is required to get the materials to the plant, process them, and distribute the final product to stores and retailers. High-priced fuel results in scaling back operations or raising prices, or both– even as consumer demand remains high or increases.

4: Higher Retail Costs

When production, manufacturing, and distribution costs increase for every imaginable product or service, you can imagine that retail prices on everything go up to maintain profits. Nobody retails anything at cost, or there wouldn’t be any value in selling anything. Markups range from 1% to 1000% or more, but there is always a markup. The cost of producing the oil, paying workers, taxing the oil, supplying manufacturers, manufacturing usable products, and getting those products to markets and consumers get passed on to the consumer. This can result in supply failures, shortages, panic buying, and lopsided supply and demand models. In a nutshell, the cost of every single thing in an oil-driven and oil-dependent economy goes up and up and up.

5: Breakdown of Fundamental Services

When production, manufacturing, and distribution costs increase for every imaginable product or service, you can imagine that retail prices on everything go up to maintain profits. Nobody retails anything at cost, or there wouldn’t be any value in selling anything. Markups range from 1% to 1000% or more, but there is always a markup. The cost of producing the oil, paying workers, taxing the oil, supplying manufacturers, manufacturing usable products, and getting those products to markets and consumers get passed on to the consumer. This can result in supply failures, shortages, panic buying, and lopsided supply and demand models. In a nutshell, the cost of every single thing in an oil-driven and oil-dependent economy goes up and up and up.

5: Breakdown of Fundamental Services

When manufacturers scale production on chemicals essential for water treatment, municipal water prices go up. When the fossil fuel price goes up, utility prices go up. With peaking demand and reduced supply, the chance of grid failure is more significant. The parts needed to maintain a healthy power grid are often sourced overseas. With supply chains continuing to struggle, it is only a matter of time when the components required for a healthy grid are no longer available. Fossil fuels are non-renewable and required for all the other fundamental utilities and services you and everyone else have become dependent upon since the first three-phase alternating current power transmission at 110 kV took place in 1907 between Croton and Grand Rapids, Michigan.

So, beyond the apparent price at the pump and the fact that there is no easy solution to plug in, you can expect large and small breakdowns, from producing resources to manufacturing to distribution to end-users and basic services. It’s not looking good.

WILL IT GET BETTER FROM HERE?

When manufacturers scale production on chemicals essential for water treatment, municipal water prices go up. When the fossil fuel price goes up, utility prices go up. With peaking demand and reduced supply, the chance of grid failure is more significant. The parts needed to maintain a healthy power grid are often sourced overseas. With supply chains continuing to struggle, it is only a matter of time when the components required for a healthy grid are no longer available. Fossil fuels are non-renewable and required for all the other fundamental utilities and services you and everyone else have become dependent upon since the first three-phase alternating current power transmission at 110 kV took place in 1907 between Croton and Grand Rapids, Michigan.

So, beyond the apparent price at the pump and the fact that there is no easy solution to plug in, you can expect large and small breakdowns, from producing resources to manufacturing to distribution to end-users and basic services. It’s not looking good.

WILL IT GET BETTER FROM HERE?

The short answer is no. As we mentioned, there isn’t a solution to fossil fuel addiction. As we mentioned at the beginning of the blog, things are about to get a whole lot worse than it already is and far worse than they are currently predicting. Profits will be maintained by scaling production to always maintain a demand imbalance. After all, what can you do about it? Go solar or buy an electric vehicle? Those panels require fossil fuels, mining, manufacturing, and distribution to create. The same is true for the electric car, but it also requires fossil fuels to get its charge. The world has realized a heyday of manufacturing and distribution, but that’s all changing in real-time. So, what can we expect over the next several years when it is clear that we will not see costs coming down?

If we can draw any parallels between the economic downturn of the 1973 OPEC oil embargo and today, respecting that the situations are different in many ways and consumption and demand are astronomically higher today than it was then, several specific outcomes become apparent. Expect businesses to have to scale back or shutter operations altogether. This means less output during a period of high demand. This means workers get laid off, prices increase, and the economic crisis worsens. This will happen through this year and next. The Fed will try and raise interest rates to counter inflation. At the time of recording this video, they just announced the largest single interest rate hike in 28 years. Additional rate hikes are inevitable because it’s one of the only control tools they have left. However, this won’t do much but slow down the speed at which money is lent. Fewer people will be buying land or property, especially since most are priced out of that market altogether. Inflation is already deeply entrenched in our economy. The lowest estimates put consumer prices up 8.6%, but that’s the rosiest of rosiest visions. The reality is that prices have gone up far past that.

Next for our economy and most of the world economies is a recession. If we aren’t already there by definition, we will be soon. Fed officials recently projected the economy would grow just 1.7% this year, down from the 2.8% growth rate they predicted three months ago. By 2023 expect the economy to contract even further. There is no soft landing anymore in the forecast. Imagine that the economy is standing on its tippy-toes on a ledge. We are all just one natural disaster or conflict away from a much larger collapse at this point.

A WARNING AND A PLAN

The short answer is no. As we mentioned, there isn’t a solution to fossil fuel addiction. As we mentioned at the beginning of the blog, things are about to get a whole lot worse than it already is and far worse than they are currently predicting. Profits will be maintained by scaling production to always maintain a demand imbalance. After all, what can you do about it? Go solar or buy an electric vehicle? Those panels require fossil fuels, mining, manufacturing, and distribution to create. The same is true for the electric car, but it also requires fossil fuels to get its charge. The world has realized a heyday of manufacturing and distribution, but that’s all changing in real-time. So, what can we expect over the next several years when it is clear that we will not see costs coming down?

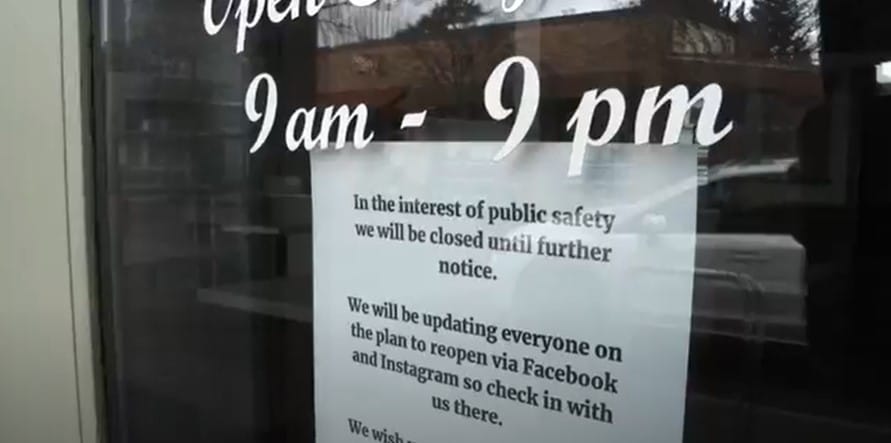

If we can draw any parallels between the economic downturn of the 1973 OPEC oil embargo and today, respecting that the situations are different in many ways and consumption and demand are astronomically higher today than it was then, several specific outcomes become apparent. Expect businesses to have to scale back or shutter operations altogether. This means less output during a period of high demand. This means workers get laid off, prices increase, and the economic crisis worsens. This will happen through this year and next. The Fed will try and raise interest rates to counter inflation. At the time of recording this video, they just announced the largest single interest rate hike in 28 years. Additional rate hikes are inevitable because it’s one of the only control tools they have left. However, this won’t do much but slow down the speed at which money is lent. Fewer people will be buying land or property, especially since most are priced out of that market altogether. Inflation is already deeply entrenched in our economy. The lowest estimates put consumer prices up 8.6%, but that’s the rosiest of rosiest visions. The reality is that prices have gone up far past that.

Next for our economy and most of the world economies is a recession. If we aren’t already there by definition, we will be soon. Fed officials recently projected the economy would grow just 1.7% this year, down from the 2.8% growth rate they predicted three months ago. By 2023 expect the economy to contract even further. There is no soft landing anymore in the forecast. Imagine that the economy is standing on its tippy-toes on a ledge. We are all just one natural disaster or conflict away from a much larger collapse at this point.

A WARNING AND A PLAN

So we have to tell you that no single policy or plan, no pundit or political party change, no increase in drilling or ramped up production is enough to dig our ways out of this one. When world leaders are coming out and acknowledging the possibilities of food and power shortages, there’s a problem far worse than that rounding the corner. So we cannot accurately tell what will be the catalyst to change our trajectory or how far in the future that change will come, but that doesn’t leave us entirely without a plan. In fact, it presents us with specific opportunities.

Your plan should be to prep to protect yourself from the world’s failings. Knowing that supply chains will continue to falter, take steps to build food reserves and reduce your dependence on global food supply chains. Get local where you can and produce, process, and preserve at least some small percentage of what you need to consume. Knowing that the energy grid, which is already highly prone to failure, is going to get even more susceptible to prolonged outages, prep your energy needs, learn to do with less or no energy, and understand how this chaos will impact the world around you, your state, town, and neighborhood. Understand that to survive, you will need to fundamentally change your spending habits. Necessities and essentials have to take center stage in your budget. Before this is over, the recession will get worse. Before this is over, millions of jobs will be lost. Whole economies may implode. The high fuel cost coupled with food shortages is a formula with only one outcome.

It is hard to fathom the more profound consequences of seven dollars or ten dollars a gallon gas. It’s challenging to comprehend the deeper, life-altering complications when we are in slack-jawed sticker shock at the pumps, but there are numerous side effects to that per-gallon price. We are in unchartered waters. Economies around the world will suffer, and some will collapse. Even investment gurus like Robert Kiyosaki, author of Rich Dad, Poor Dad, advised his 1.9 million Twitter followers to invest in cans of tuna fish and baked beans. He wrote, “Best investments are cans of tuna & baked beans. You can’t eat gold, silver, or Bitcoin. You can eat cans of tuna and baked beans. Food most important. Starvation next problem. Invest in the solution.” Even he is becoming a prepper. He is also a new prepper who would be making a mistake by limiting his prepping to hoarding cans of beans and fish. Don’t make his mistake, but work from a complete plan like what We outline in my Prepper’s Roadmap course. For your part, double down on your food and water preps, but realize the whole world is about to do the same. Take it a step further and reduce dependencies and start producing part of what you consume. Think beyond gas, wheat, corn, and electricity today, and prep a better tomorrow for yourself.

We have grown accustomed and desensitized to rising fuel costs over the last 50 years, but trust me, this time, it’s different. We are driving into a storm here. Visibility is about to drop to zero, and the clouds show no signs of clearing up anytime soon. The prepping choices you make today will influence your path and where it leads you.

As always, stay safe out there.

So we have to tell you that no single policy or plan, no pundit or political party change, no increase in drilling or ramped up production is enough to dig our ways out of this one. When world leaders are coming out and acknowledging the possibilities of food and power shortages, there’s a problem far worse than that rounding the corner. So we cannot accurately tell what will be the catalyst to change our trajectory or how far in the future that change will come, but that doesn’t leave us entirely without a plan. In fact, it presents us with specific opportunities.

Your plan should be to prep to protect yourself from the world’s failings. Knowing that supply chains will continue to falter, take steps to build food reserves and reduce your dependence on global food supply chains. Get local where you can and produce, process, and preserve at least some small percentage of what you need to consume. Knowing that the energy grid, which is already highly prone to failure, is going to get even more susceptible to prolonged outages, prep your energy needs, learn to do with less or no energy, and understand how this chaos will impact the world around you, your state, town, and neighborhood. Understand that to survive, you will need to fundamentally change your spending habits. Necessities and essentials have to take center stage in your budget. Before this is over, the recession will get worse. Before this is over, millions of jobs will be lost. Whole economies may implode. The high fuel cost coupled with food shortages is a formula with only one outcome.

It is hard to fathom the more profound consequences of seven dollars or ten dollars a gallon gas. It’s challenging to comprehend the deeper, life-altering complications when we are in slack-jawed sticker shock at the pumps, but there are numerous side effects to that per-gallon price. We are in unchartered waters. Economies around the world will suffer, and some will collapse. Even investment gurus like Robert Kiyosaki, author of Rich Dad, Poor Dad, advised his 1.9 million Twitter followers to invest in cans of tuna fish and baked beans. He wrote, “Best investments are cans of tuna & baked beans. You can’t eat gold, silver, or Bitcoin. You can eat cans of tuna and baked beans. Food most important. Starvation next problem. Invest in the solution.” Even he is becoming a prepper. He is also a new prepper who would be making a mistake by limiting his prepping to hoarding cans of beans and fish. Don’t make his mistake, but work from a complete plan like what We outline in my Prepper’s Roadmap course. For your part, double down on your food and water preps, but realize the whole world is about to do the same. Take it a step further and reduce dependencies and start producing part of what you consume. Think beyond gas, wheat, corn, and electricity today, and prep a better tomorrow for yourself.

We have grown accustomed and desensitized to rising fuel costs over the last 50 years, but trust me, this time, it’s different. We are driving into a storm here. Visibility is about to drop to zero, and the clouds show no signs of clearing up anytime soon. The prepping choices you make today will influence your path and where it leads you.

As always, stay safe out there.